NSE Emerge, launched by the National Stock Exchange (NSE) in 2012, serves as a devoted platform for small and medium-sized enterprises (SMEs) and startups in India to entry capital markets. The platform permits SMEs to lift funds by way of public choices with out the complexities related to conventional Initial Public Offerings (IPOs).

Key Features of NSE Emerge

- Accessibility: NSE Emerge permits SMEs to listing their shares with lowered compliance necessities in comparison with mainboard IPOs. Companies can safe funding by acquiring approval from the NSE board fairly than going by way of the Securities and Exchange Board of India (SEBI).

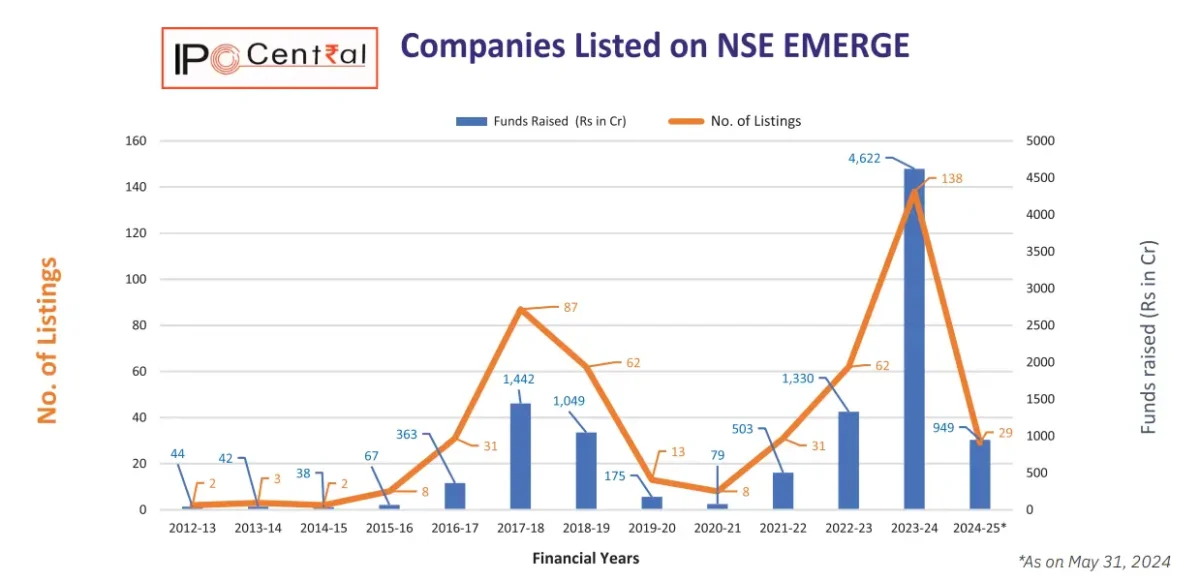

- Funding Opportunities: Since its inception, NSE Emerge has seen vital participation from SMEs. As of 30 September 2024, 556 corporations have listed on this platform, elevating roughly INR 14,145 crore collectively. This demonstrates the platform’s effectiveness in connecting companies with potential buyers.

- Market Capitalization Growth: The market capitalization of corporations listed on NSE EMERGE crossed INR 1,45,385 crore in March 2024, highlighting the rising confidence in India’s SME sector. The Nifty SME EMERGE Index, which incorporates 329 corporations from numerous sectors, has proven a exceptional compound annual progress fee (CAGR) of 42.67% since its launch in 2017.

NSE Emerge Index

The NSE Emerge Index is designed to characterize the efficiency of a portfolio of eligible small and medium enterprises (SMEs) listed on the NSE Emerge platform. The constituents of this index are weighted in keeping with their free-float market capitalization.

Highlights

- Base Date and Value: The index has a base date of 1 December 2016, with a base worth set at 1000.

- Eligibility Criteria: To be included within the NSE Emerge Index, shares should meet the next necessities:

- They should be listed on the NSE Emerge platform.

- During the quarterly evaluate, they need to have traded for at the least 25% of the buying and selling days, with a minimal of 10 buying and selling days within the previous three months.

- Minimum Constituents: The index requires a minimal of 20 constituents.

- Reconstitution Frequency: The index is reconstituted quarterly to make sure it precisely displays the efficiency of eligible SMEs.

Interested in NSE? More Articles For You

Recent Developments

The NSE has just lately tightened itemizing norms to make sure larger high quality amongst SMEs looking for to go public. New standards embrace:

- Positive Free Cash Flow: Starting September 2024, solely corporations demonstrating constructive free money movement to fairness for at the least two out of the final three monetary years might be eligible for itemizing. This measure goals to boost investor safety and make sure that solely financially sound corporations enter the market.

- Price Cap on IPOs: The NSE has imposed a cap on the opening worth of SME IPOs at 90% above the difficulty worth. This choice was made to standardize worth discovery and mitigate dangers related to extreme hypothesis and potential manipulation in share costs.

NSE Emerge Listing Eligibility Criterion

The circumstances and eligibility standards for itemizing on the NSE Emerge platform for Small and Medium Enterprises (SMEs) are outlined in a number of key areas:

Eligibility Criteria for Listing

As of the date of submitting the Public Offer Document with NSE, the next standards should be met:

| Parameter | Listing Criterion |

|---|---|

| Incorporation | The issuer should be an organization included beneath the Companies Act 1956/2013 in India. |

| Post Issue Paid Up Capital | The post-issue paid-up capital should not exceed INR 25 crore. |

| Track Record | At least three years of operational historical past for the applicant or promoters. |

| Positive working revenue for at the least 2 out of the final 3 monetary years. | |

| Positive Free Cash Flow to Equity (FCFE) for at the least 2 out of the final 3 monetary years. | |

| Other Listing Conditions | No insolvency proceedings or winding-up petitions towards the corporate. |

| No materials regulatory actions towards the corporate previously three years. | |

| Disclosures | Must disclose any materials regulatory actions or defaults in funds during the last three years. |

| Rejection Cooling-off Period | The utility shouldn’t have been rejected by the Exchange within the final six months. |

Additional Notes

- Promoters’ Qualifications: Promoters should have a minimal of three years of expertise within the related enterprise and maintain at the least 20% of post-issue fairness share capital.

- Financial Health: Companies should show constructive internet price and operational profitability to qualify for itemizing on this platform.

These standards purpose to make sure that solely financially secure and operationally sound SMEs can entry public funding by way of the NSE Emerge platform, thereby enhancing investor confidence and market integrity.

Also Read: Nifty 50 Stock List in 2024

Regulatory Framework: Emerge vs. Main Board

| Particulars | Emerge | Main Board |

|---|---|---|

| Post-Issue Paid-Up Capital (Face Value) | Less than INR 25 crore | Not lower than INR 10 crore |

| Minimum Number of Allottees within the IPO | 50 | 1,000 |

| Observations on DRHP | By the Exchange | By SEBI |

| IPO Application Size | Not lower than INR 1,00,000 | INR 10,000 – 15,000 |

| Post-Issue Reporting Requirements (Financial Accounts) | Half-yearly | Quarterly |

| Market Making | Mandatory | Non-mandatory |

Trading Lot Sizes for NSE Emerge

Standardized lot dimension for Initial Public Offer proposing to listing on EMERGE and for the secondary market buying and selling:

| Price Band (in INR) | Lot Size (no. of Shares) |

|---|---|

| Upto 14 | 10,000 |

| More than 14 upto 18 | 8,000 |

| More than 18 upto 25 | 6,000 |

| More than 25 upto 35 | 4,000 |

| More than 35 upto 50 | 3,000 |

| More than 50 upto 70 | 2,000 |

| More than 70 upto 90 | 1,600 |

| More than 90 upto 120 | 1,200 |

| More than 120 upto 150 | 1,000 |

| More than 150 upto 180 | 800 |

| More than 180 upto 250 | 600 |

| More than 250 upto 350 | 400 |

| More than 350 upto 500 | 300 |

| More than 500 upto 600 | 240 |

| More than 600 upto 750 | 200 |

| More than 750 upto 1000 | 160 |

| Above 1000 | 100 |

Price Bands

Price bands for securities are as follows:

- Daily worth bands of 20% (both manner)

- Price Bands could also be modified as per surveillance motion now and again.

- For the Call Auction 1 market, the worth bands of 20% are relevant

Circuit Breakers

If the capital market of the primary board is closed resulting from a nationwide index circuit filter or for another cause, the Emerge platform can even be closed. It will reopen concurrently when the capital market resumes buying and selling.

Impact on SMEs and Startups

NSE Emerge has confirmed to be a catalyst for financial progress by offering SMEs with a reputable platform for fundraising. The skill to lift capital by way of public markets empowers these companies to broaden operations, create jobs, and contribute considerably to India’s financial panorama. The pattern of migration from the SME platform to the primary board can also be noteworthy; as of now, 138 corporations have efficiently transitioned, indicating that many SMEs are maturing into bigger entities able to assembly extra stringent regulatory necessities.

Milestones Achieved

- five hundredth Listing Celebration: On 22 July 2024, Prizor Viztech turned the five hundredth firm listed on NSE Emerge, and Thejo Engineering was the primary. This milestone displays an accelerated tempo of listings, with the final 100 corporations listed inside simply six months—a stark distinction to the 5 years it took to succeed in the primary 100 listings.

- Significant Fund Mobilization: July 2024 alone noticed a document mobilization of INR 11,186.02 crore from 23 listings, showcasing buyers’ rising curiosity in SME IPOs.

Challenges and Regulatory Measures

Despite its successes, NSE Emerge faces challenges associated to firm high quality and market manipulation issues. Recent regulatory measures purpose to deal with these points:

- Stricter Listing Norms: The introduction of constructive money movement necessities is predicted to filter out corporations that will not be financially secure or sustainable.

- Investor Caution: Regulatory our bodies have issued warnings relating to potential manipulations in SME inventory costs, urging buyers to conduct thorough due diligence earlier than investing.

Role of Merchant Bankers in NSE Emerge

Merchant bankers play a vital function within the NSE Emerge platform by managing the IPO course of for SMEs. They help in due diligence, put together providing paperwork, set share costs, and guarantee regulatory compliance. Additionally, they facilitate market-making for 3 years post-listing, enhancing liquidity and investor confidence in these rising corporations.

Roles and Responsibilities of Market Makers

The following are the roles, obligations and obligations which might be required to be carried out by the Market Maker.

- The Market Maker shall be required to offer a 2-way quote for 75% of the time in a day.

- The minimal depth of the quote shall be INR 1,00,000/-. However, the buyers with holdings of worth lower than INR 1,00,000 shall be allowed to supply their holding to the Market Maker in that scrip supplied that he sells his complete holding in that scrip in a single lot together with a declaration to the impact of the promoting dealer.

- Execution of the order on the quoted worth and amount should be assured by the Market Maker, for the quotes given by him.

- There wouldn’t be greater than 5 Market Makers per scrip.

- The Market Maker might compete with different Market Makers for higher quotes to the buyers.

- The Market Maker has to begin offering quotes from the day of the itemizing / the day for the respective scrip and shall be topic to the rules laid down for market making by the trade.

- The Market Maker has to behave in that capability for 3 years.

Read Also: Latest SEBI IPO Approvals

Conclusion

NSE Emerge represents a significant alternative for SMEs and startups in India, providing them a pathway to monetary progress and market visibility. With ongoing enhancements in itemizing standards aimed toward sustaining high quality and investor confidence, this platform is poised to proceed enjoying a necessary function in nurturing India’s vibrant SME ecosystem. As extra companies acknowledge the advantages of going public by way of NSE Emerge, we are able to anticipate additional contributions to financial improvement and innovation throughout numerous sectors.

Source link

#Explore #NSE #Emerge #Platform #Insights #Listing #Norms #NSE #Emerge #Index